LTV/CAC Ratio: What Is a Good LTV to CAC Ratio and How to Improve Yours

The process of obtaining new leads and turning them into conversions requires investing in marketing for your business. After putting in the effort to deliver a tailored experience, you feel delighted to have those leads convert. But sometimes, the cost to convert those leads can be greater than they’re worth.

That’s why you must track your Lifetime Value (LTV) and Customer Acquisition Costs (CAC) ratio to ensure you aren’t overspending to obtain leads. This ratio will help you keep your marketing costs in control to earn more revenue for your business.

Keep reading to get answers to your burning questions, including:

- What are LTV and CAC?

- Why do I need to look at the LTV/CAC ratio?

- What is the LTV/CAC formula?

- What is a good LTV to CAC ratio?

- How do I improve my LTV/CAC ratio?

P.S. Want to get the latest marketing tips to help keep your marketing costs low and your profits high? Join 190,000+ savvy marketers by subscribing to Revenue Weekly!

For even more digital marketing advice, sign up for the email that more than 190,000 other marketers trust: Revenue Weekly.

Sign up Today!

What are LTV and CAC?

You may have heard of LTV and CAC, but what are they?

Lifetime Value (LTV) is the worth of a customer over the time of their relationship with your business. This metric predicts how much this customer or client is worth, based on how long they likely stay with your company or continually buy from you.

Customer Acquisition Cost (CAC) is the amount you spend to obtain customers. This amount accounts for all the money you spend on marketing, your sales team, and more.

Why do you need to look at LTV/CAC ratio?

When looking at LTV and CAC, you may wonder why you need to monitor these two metrics together. LTV and CAC are important for understanding if you’re getting a return on the money you spend to acquire customers.

Tracking the LTV/CAC ratio lets you see if you’re spending too much to market to customers.

For example, you may spend $1000 to market to a customer to get them to convert. When they do convert, you find their LTV is only $500. That means that obtaining the customer won’t make up all the money you spend to market to them.

Tracking your LTV/CAC ratio helps you get a glimpse into how much you’re spending compared to how much you’re getting in return so that you can adjust your marketing tactics accordingly.

LTV CAC formula: How to calculate your LTV/CAC ratio?

Now that you know the importance of the LTV/CAC ratio, it’s time to calculate your ratio to figure out if it’s a good one. Calculating your ratio requires following this simple LTV CAC formula:

Lifetime Value / Customer Acquisition Cost=LTV/CAC Ratio

If you want to find your LTV CAC benchmark, it’s as simple as taking your lifetime value and dividing it by your customer acquisition cost. So, if your lifetime value is $1000 and the CAC is $500, your ratio is 2:1.

Don’t know how to calculate your lifetime value or customer acquisition cost? Use our free LTV calculator and free CAC calculator to find your numbers now!

What is a good LTV to CAC ratio?

So, what is a good LTV to CAC ratio? There is a narrow area where you want your business to fall in terms of balancing marketing and getting enough valuable customers.

The LTV CAC benchmark is 3:1. This ratio is a good target because it indicates that you’re spending enough on marketing to acquire customers, and those customers bring substantial and steady value.

If your ratio is lower than the LTV CAC benchmark, like 1:1, you’re losing more money than what you’re acquiring from customers. It indicates that your marketing costs are high, but the lifetime value from your customers is too low.

If your ratio is 3:1 or 4:1, you’re in a good place. This LTV CAC benchmark is where you want to be because it indicates your marketing and customer value achieved balance.

Now, if your LTV/CAC ratio is 5:1 or higher, you’re not spending enough on marketing. You may be thinking, “Well doesn’t that mean I’m getting high-value customers without spending a lot on marketing?”

To some degree, yes. But even more so, this number indicates that you’re missing opportunities to acquire customers faster. It means your sales and marketing are struggling to keep up with the growth, which could end up hurting your business in the long run.

Balance is key, which is why the LTV CAC benchmark of 3:1 is a perfect target for harmony between your CAC and LTV.

How to improve LTV/CAC ratio

If you’ve used the LTV CAC formula and found you’re unhappy with your ratio, there are steps you can take to improve your ratio. Let’s look at some ways to fix your current strategies if you don’t have a good LTV to CAC ratio:

LTV/CAC ratio below 3:1

If your ratio is below 3:1, you need to look at your marketing expenses. A low LTV to CAC ratio indicates you’re overspending on marketing and may need to make some adjustments or cutbacks.

Some cost-effective methods you can use to help curb your marketing costs include:

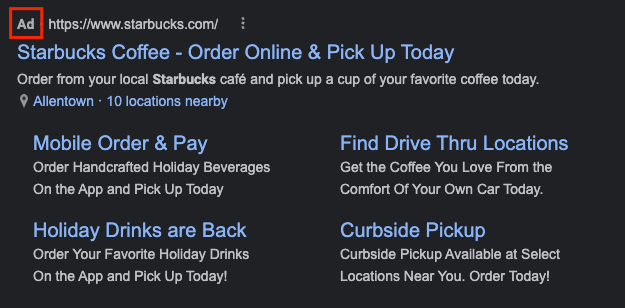

- Pay-per-click (PPC) advertising: PPC ads are paid ads that appear at the top of search results. These paid ads allow you to set your budget, and you only pay when people click on them. PPC is an excellent option for cost-effective marketing because it gives you budget control.

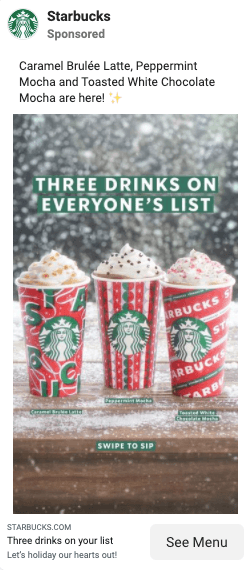

- Social media advertising: Social media ads appear in users’ newsfeeds when they browse on social platforms. With social ads, you choose your budget and can set daily limits to ensure you don’t spend all your budget in one day. It’s a great option to reach more customers over time.

- Content marketing: Content marketing involves sharing your knowledge and expertise with your audience through blogs, guides, and videos. This strategy is cost-effective because you can create evergreen content, which stays relevant over time and continually drives traffic for your business.

These strategies are great, budget-friendly options if you find your current marketing isn’t cutting it.

LTV/CAC ratio above 4:1

If your LTV/CAC ratio is above 4:1, it’s time to start investing in marketing channels that help you acquire customers faster and make it easier for your sales team to keep up with demands.

Here are some great methods to help you market more effectively:

- Search engine optimization (SEO): SEO is the process of boosting your website’s ranking in search results to drive more qualified traffic. This strategy helps drive people to your business when looking for relevant information, products, or services. It allows you to reach people at the right time to drive sales more efficiently.

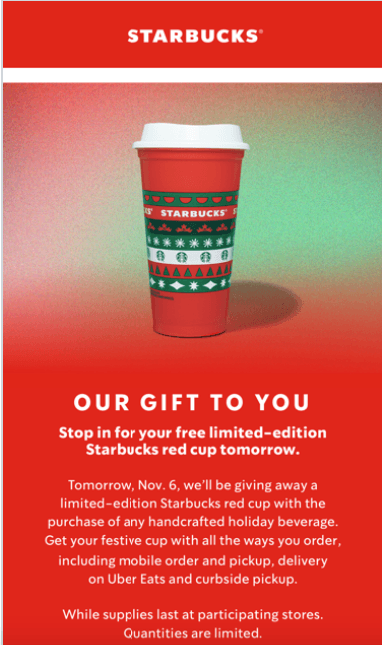

- Email marketing: Email marketing involves sending relevant and tailored emails straight to users’ inboxes. Email is a great way to nurture leads towards conversion faster by sending applicable promotions straight to them.

- Remarketing: Remarketing is a strategy that involves marketing to people who showed previous interest in your business. This strategy helps you turn prospects into customers faster by reminding them of their interest in your product or service and inviting them to come back and convert.

These marketing methods are a great option if you’re looking for a good LTV to CAC ratio for your business.

Need help improving your LTV/CAC ratio?

Having a good LTV to CAC ratio is critical if you want your business to spend your budget wisely on marketing. Since marketing is a crucial component of your online success, you must balance your LTV to CAC ratio.

If you need help revamping your marketing to have a better LTV/CAC ratio, WebFX is here to help. With over a decade of experience in digital marketing, we know how to craft marketing campaigns that help you earn more customers and market effectively.

We’ve driven over $2.4 billion in revenue and over 6.3 million leads for our clients in the past five years alone. We’re ready to help you get to a good LTV to CAC ratio!

Contact us online or call us today at 888-601-5359 to speak with a strategist about our digital marketing services!