Your Guide on How to Manage a Marketing Budget

If you’re in charge of your business’s marketing team, part of your job involves knowing how to manage a marketing budget. After all, your paid ads and web design updates don’t run on an empty wallet. Your company entrusts you to manage the funds for those marketing tactics.

But chances are, you’re not a finance expert. You may know a lot about search engine optimization (SEO) and social media marketing, but when it comes to creating and maintaining a budget, you may be in unfamiliar territory.

While budget planning can seem like a daunting task, it’s not too complex once you understand the best ways to maximize your budget. In this post, we’ll walk through how to create a marketing budget for your business.

Of course, a detailed marketing plan can only take you so far if your marketing strategies aren’t bringing in revenue. To get help boosting your return on investment (ROI), consider partnering with WebFX. We’ve helped over 1000 businesses, and we’d love to add you to the list!

To get started with us, just call us at 888-601-5359 or contact us online today!

Over the past 5 years, we’ve generated: in client revenue leads for our clients client phone callsOur digital marketing campaigns impact the metrics that matter most!

1.5 Billion

4.6 Million +

1.8 Million

What is a marketing budget?

A marketing budget is a plan that outlines how much you can spend on marketing and where you’ll allocate funds for different marketing strategies. Marketing budgets include expenses for strategies, but can also include additional costs like purchasing software or outsourcing work.

The pre-planning process: How to prep to plan your marketing budget

The full budget planning process often takes around two months, but that can vary greatly depending on your business. It takes time to develop your marketing budget, so it’s critical that you spend time pre-planning to expedite the process.

Creating a detailed marketing plan varies from business to business, but it most often starts with some form of communication between you and your superiors about how much money you can spend on marketing. There are four typical models of budgeting for marketing:

- Revenue percentage: You receive a set percentage of the company’s total revenue — usually between 5% and 20% — each spending period.

- Competition-based: You receive however much money you need each spending period to match whatever your competitors are doing.

- Top-down: Your superiors give you an amount that they decide on without your input, and you distribute it as best you can.

- Bottom-up: You use a goal-based approach to determine how much money you think you need for that spending period, and your superiors approve it.

In the case of the first three options, marketing teams don’t typically get much input — they more or less just have to work with what they’re given. Often, however, businesses use a blend of two or more of these approaches, particularly top-down and bottom-up.

For example, your superiors might provide you with a set of spend targets to plan within. Then you plan for specific ways to allocate money within those spend targets and propose the final plan to your superiors for approval.

Researching and goal-setting

Once you hear from your superiors about your spend targets, it’s time to start planning how to use the money they’re allocating for marketing. But don’t immediately start assigning that money to various activities or campaigns.

Do your research

Before you get into the meat of the planning process, find time to do some thorough research around your company. Make sure you know:

- The current state of your industry

- Your competition

- Your market

- Your products

- Your customer personas

Additionally, you’ll want to determine what your buyers’ journey looks like, so you can understand how to market to your audience better.

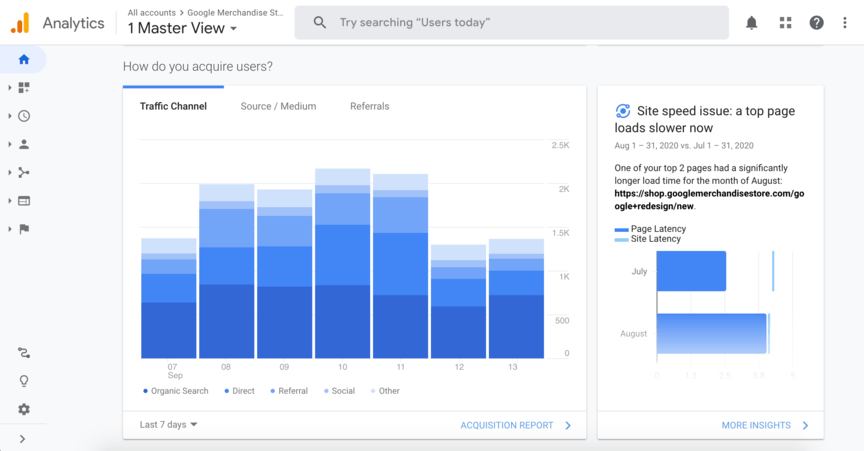

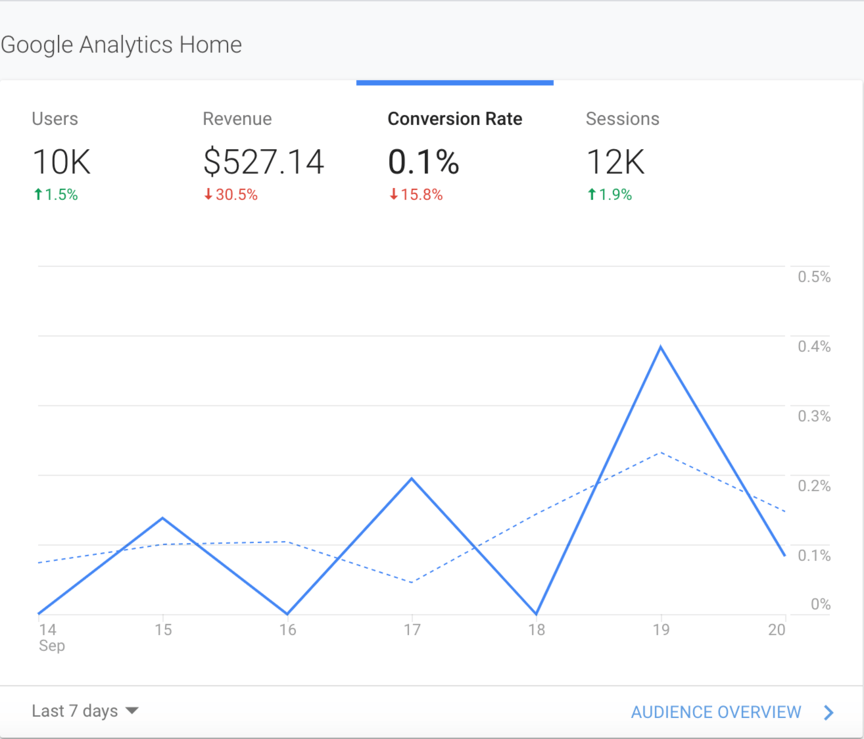

Likewise, know how many visits, leads, and conversions you earn per month, as well as the values and costs associated with each of those. You can get a lot of valuable information along these lines from Google Analytics.

Once you have all this information in mind, you can more accurately decide how to manage your marketing budget.

Set SMART goals

Another critical component of preplanning your marketing budget is determining goals. Specifically, work to develop a list of SMART goals — goals that are specific, measurable, attainable, realistic, and timely — for your marketing team.

SMART goals keep you from creating vague goals . A goal like “increase revenue” isn’t specific enough to plan a budget around. A better version of that goal would be “increase ROI for X pay-per-click (PPC) campaign by Y%.”

Here are some other example SMART goal templates:

- Increase the amount of content written each month by X%.

- Generate X more Facebook followers this spending period.

- Earn at least X backlinks for each piece of content published.

- Increase traffic to X product page by Y% by the end of this spending period.

If you need helping knowing what specific numbers to aim for, you can look at industry benchmarks and past budget numbers.

As a longer-term solution, you can also try testing out different marketing strategies to see what works best for your business so you know what to focus your resources on. Maybe you find that your business doesn’t do so well on social media, but your PPC really drives results.

Make sure you don’t skimp on the goal-setting stage. Don’t throw five goals onto a page and call it a day. You need to account for everything you intend to accomplish with your marketing resources during the upcoming spending period.

That’s because once you’ve finished crafting the goals you want to pursue for this spending period, you have to align your budget with them. Your SMART goals will be your guiding principles throughout the rest of this marketing budget breakdown.

Persuasive benefits

Goals are crucial to helping you manage your marketing budget. On top of helping keep you accountable for the way you spend your money, a goal-driven mindset puts you in a great position to negotiate with your superiors to keep or acquire money for your team later on.

This is even better if you can pair your argument with proof that your marketing actually works, in the form of high ROI.

At WebFX, we work to earn the highest possible ROI for clients. If you’re looking to improve your spend targets, consider partnering with us!

Planning your budget

Now that you have your budget amount and laid out your goals, it’s time to move into the next phase of our marketing budget breakdown: How to create a marketing budget.

List your budget items

The next step involves coming up with a list of specific tasks and activities that will help you achieve your goals. Here are some good examples of what these could look like:

- Hire X new marketing writers to increase the amount of written content.

- Create X new sponsored posts on Facebook during this spending period.

- Design and maintain X new PPC ads to direct users to Y product page.

- Produce X YouTube video ads during this spending period.

These activities should resemble SMART goals in terms of being specific and actionable, but this time, they’re specific tasks you could allocate money toward. They can cover many different aspects of marketing, including — but certainly not limited to — the following:

- Digital ad spend

- Video production

- Branding

- Website design and development

- PR campaigns

- Event promotion and hosting

- Marketing automation tools

- Employee salaries

- Agency and consultation fees

You may also want to think about focusing on brand awareness tactics. This is true of any business, but especially newer ones.

As you can see from the above list, this isn’t just about what you’d like to do — some of it is about what you have to do. Employee salaries aren’t something you want to forget about as you manage your marketing budget.

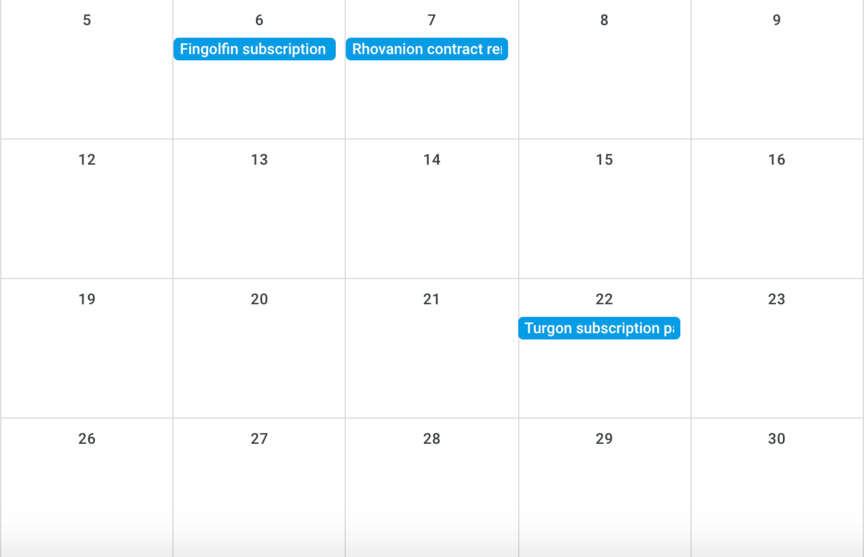

Likewise, you need to make sure to plan for “hidden costs” — purchases you made last spending period that won’t go through until this spending period, or any monthly subscription costs you may have.

Calculate costs

Once you have a full list of activities you could benefit from implementing, go back through it and assess how much each item would cost. This step can be tricky, since estimating cost looks different for every activity. Furthermore, the price can vary greatly for certain items, like PPC.

Do the best you can to judge how much you expect to spend on each activity. With that being said, here are a few tips you can use to help you do that:

- Start off easy: Start by listing the costs that are easiest to figure out. For things like your current employees’ salaries, you already know how much to put down. The same is true of any activities that come with a set fee, like software.

- Set boundaries: Some activities, like PPC campaigns, don’t have a fixed cost — they cost however much you’re willing to pay for them. For each of these items, you can put down the minimum and maximum amounts that you’d be willing to spend on it.

- Use past numbers: Often, you can learn more from your own budget history than anything else. Look at your marketing team’s past spending numbers to help you see how much you typically spend on a given activity.

Once you have a cost estimate down for all the items on your list, add them all up and see what you get.

Odds are, it’s vastly beyond the scope of your budget.

Don’t worry — that’s to be expected! Your original list is a brainstorming session, with you recording everything you’d like for your marketing team to be able to do. You won’t feasibly be able to do all of it, though, which takes us to the next step in how to create a marketing budget.

Cut down your list

The next step in our marketing budget breakdown involves cutting your list down to size. Go through and figure out where your priorities lie. Which activities are absolutely essential? Which ones could you do without? Which ones might you be able to spend less money on?

Keep your SMART goals in mind as you do this, too. Make sure you don’t leave any activities on the list that don’t directly contribute to one or more of your goals. These cuts should lead you toward a rough version of your detailed marketing plan.

Here are some other tips for planning your budget at this stage:

- Plan for change: No matter how well-organized your business is, you can expect some changes to the budget during the spending period. Consider leaving a bit of wiggle room in your budget to account for these changes.

- Prepare for the worst: Plan ahead for some worst-case scenarios as well. Sometimes there are budget cuts, reallocations of money, and employee terminations. Think about creating one or two budget items you could pull money from in an emergency, should one arise.

- Consider ROI: Take a look at ROI from past spending periods to see which activities worked for you and which ones didn’t. Something with exceptionally low ROI should probably be cut from this spending period’s budget, if possible.

- Diversify your spending: It can be tempting to devote all your money to the one item that generates the highest ROI, but that’s not the best idea. Try to spread out your budget across different marketing strategies to increase your options.

Keep an eye on the total cost as you cut things from the list. Eventually, you should be able to work it down to a detailed marketing plan that fits within your spend targets.

If you want to keep more things from your original list, you either must spread your money more thinly or work out a way to increase your spend targets.

That’s one more reason to partner with WebFX to raise your ROI. With over 500 client testimonials, we’re commited to helping you find the strategies that work best for your business and budget!

Get company approval

Once you have a number that matches your spend targets, triple-check that everything on your list aligns with your SMART goals and finalize the amount of money you plan to devote to each strategy.

For things like social media advertising or PPC, which essentially cost however much money you choose to put into them, you can use our marketing calculator to get recommendations on how much you should spend.

With that done, refine your list as needed, and then you’re ready to send it off for internal review.

At this point, some back-and-forth will probably happen. Your superiors will assess your budget plan for compliance and performance. They’ll look to see if the total cost complies with their spend targets, and whether the different activities will benefit the company.

Based on their feedback, you may have to make some changes. At some point, though, it will meet with approval, and your budget will be complete.

Leah Pickard. ABWEMid-Size Businesses Trust WebFX

Managing your marketing budget

Congratulations on creating your new budget! Now that that’s done, you can finally begin to manage your marketing budget.

Create spreadsheets

Before the spending period begins, you’ll want to create a thorough spreadsheet to track everything from this marketing budget breakdown. A good spreadsheet is the key to keeping your spending aligned with your budget.

In fact, you can benefit from having multiple spreadsheets. You can have one template that tracks all your marketing expenses, but also have some for tracking individual categories or campaigns in greater detail. You can have one for SEO, another for PPC, and another for content.

Update these spreadsheets frequently as you go through the spending period. Your detailed marketing plan doesn’t do you any good if you don’t use it to keep your spending on track. Aim to update your spending at least once a week.

Keep track of expenses

To help yourself keep track of any automated expenses or monthly payments such as subscriptions or contract renewals, consider creating a calendar with dates and reminders.

Something that’s a bit harder to keep track of, though, is employee spending. Sometimes it’s software payments and contract renewals, while other times it’s new hires. But with it happening across multiple people on multiple platforms, it can be hard to consolidate.

If you have a spend management system, it likely has a feature for automatically registering these various payments and updating your budget accordingly. If not, just make sure you stay on top of tracking employee spending.

Tag items as paid or unpaid

Another idea to help you manage your marketing budget is to tag items in your budget based on whether they’ve already been paid or not.

Sometimes you’ll need to move money around or replace one activity with another, and that’s much easier to do when you know which budget items are flexible versus which ones are already set in stone. Tagging them as paid or unpaid makes things easier on everyone.

Keep experimenting

Once you’ve found a strategy that works great for your business, continue using it, but don’t become a stick in the mud. Even if 90% of your budget stays the same each spending period, always use that last 10% to test out new and different options.

Note possible improvements

You shouldn’t focus solely on the current spending period, either. Think about what you can do to help yourself out during your next budget planning phase. Throughout the spending period, constantly look at the ROI of different budget items and make notes on how you can improve it.

Preserve any mid-spending period changes

As previously noted, sometimes your budget will have to be adjusted mid-spending period. When that happens, you’ll have to replace your original numbers with new ones.

But before you do, make a copy of your original budget — don’t overwrite it! When you plan for the next spending period, you can use the difference between your original and modified budget as a guide to what changes you might be able to expect.

Analyze your performance

It’s never easy to manage a marketing budget, but one thing that can make it much easier is tracking your marketing performance. You’ll want to track key performance indicators (KPIs) such as cost per lead, average customer value, bounce rates, and conversion rates.

Platforms like Google Analytics can provide you with a lot of this information, so look into setting up that or some other tools with your website. Knowing this information is critical to seeing what budget items are actually proving helpful.

Ending a spending period

When you reach the end of the spending period, go all the way back to your SMART goals. Run through all the activities in your detailed marketing plan that you spent money on, and make sure they all ended up contributing to your goals.

Then reevaluate your goals and your budget for the upcoming spending period. If any of your recent expenses failed to contribute to your goals, you may want to consider cutting them from next period’s budget.

It’s also around this time that your finance department will ask you to reconcile your actuals — in other words, to verify that the amount of money you spent matches the amount of money that left the company bank account.

This essentially requires you to work your way through everything you spent money on for the entire period and add up all the costs, and it can be a pain. To make it easier on everyone, try to reconcile more frequently than just once per spending period — maybe every two weeks.

Drive up your ROI with WebFX

Hopefully, you now know how to create a marketing budget, how to manage it, and how to improve it going forward. But the success of a budget is largely dependent on how much money goes into it.

The more money your marketing brings in, the more money your superiors will be willing to send your way at the beginning of each spending period. That’s why you need WebFX.

With over 20 years of experience in the digital marketing industry, we have what it takes to propel your ROI to new heights and maximize your ability to manage your marketing budget.

Just call 888-601-5359 or contact us online to get started with us today!